On August 30, Crypto Raver HK and the 14th MINAX Brand Listing Forum were successfully held in Hong Kong. This industry grand event, focusing on the “Integration of Real-World Assets (RWA) and Global Finance”, attracted numerous heavyweight guests from the political, business, academic, blockchain, and investment circles. As one of the co-organizers of the forum, MINAX became the focus of the entire event through a series of actions including the launch of its global site, brand bell-ringing, and strategic signings, further consolidating its leading position in the field of compliant brand RWA.

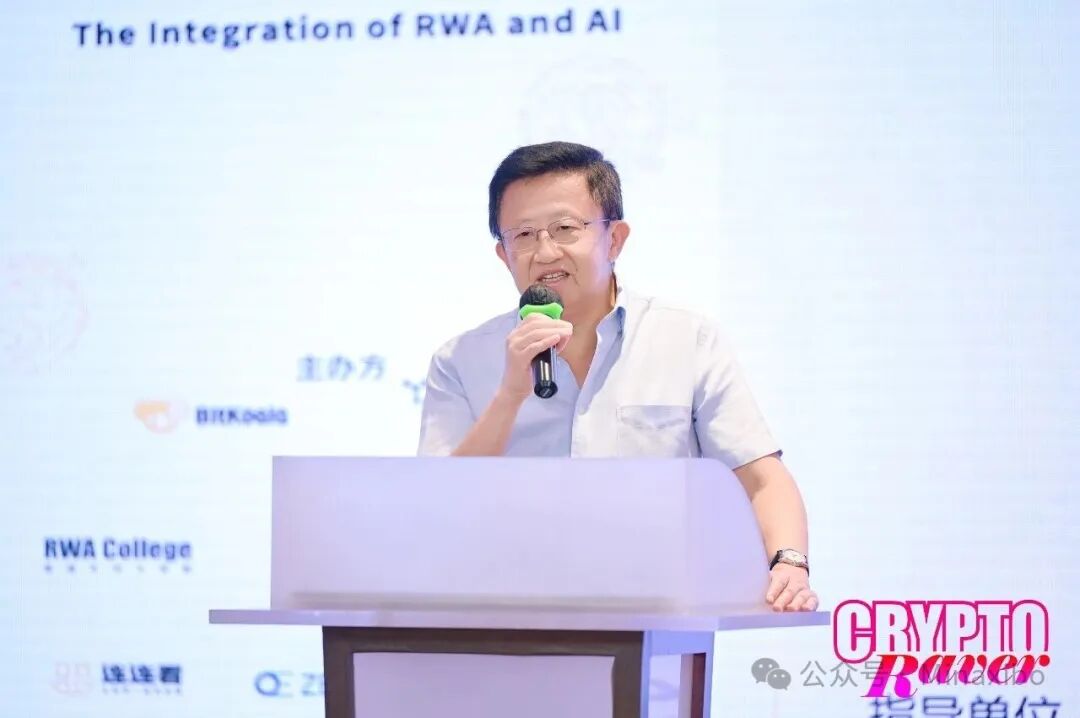

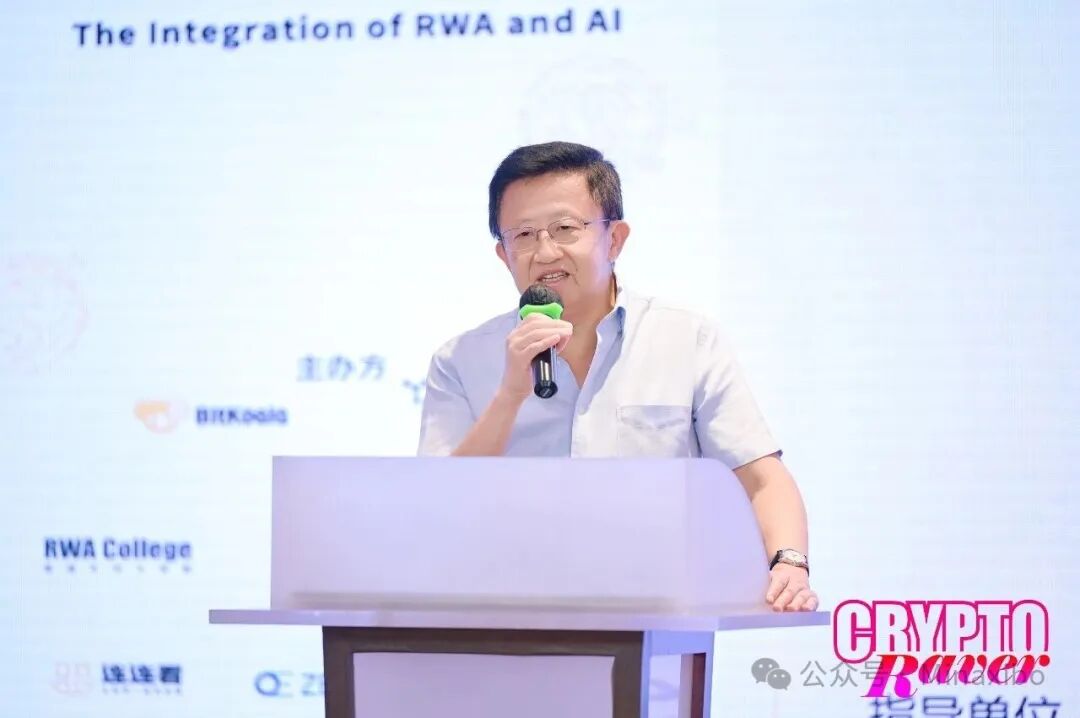

The forum agenda centered on the in-depth connection between RWA and stablecoins. Among the speakers, Mr. Gong Fangxiong, Chairman of the MINAX Board of Directors and former Managing Director of J.P. Morgan Asia Pacific, delivered a speech with the core theme of “The Cornerstone Role of Stablecoins in the RWA Ecosystem”. From the perspective of the global financial market, he explained the value logic of stablecoins in simple terms: “Stablecoins are not just ‘digital cash’; they are a ‘bridge’ connecting real-world assets and the blockchain world. Especially in the RWA field, users need a ‘reliable value carrier’—one that not only has the stability of fiat currency but also adapts to the circulation needs of global assets.” He specifically mentioned that MINAX has always adhered to the principle of “compliance first”, and will explore more opportunities for integrating stablecoins with brand RWA in the future, allowing ordinary investors to share the dividends of brand asset growth through safe and compliant means. “This is not only the direction of financial innovation but also MINAX’s commitment to users.”

Chairman of the MINAX Board of Directors

Former Managing Director of J.P. Morgan Asia Pacific – Mr. Gong Fangxiong

In the “RWA and Stablecoins” roundtable (hosted by Dai Shanshan, CEO of BitKoala and first Executive Director of RWA College), many guests shared insights from different perspectives, with clear and focused core ideas:

- Mr. Gong Fangxiong, Chairman of the MINAX Board of Directors and former Managing Director of J.P. Morgan Asia Pacific: From a traditional financial perspective, he believes that stablecoins need to be pegged to fiat currency and rely on traditional financial tools to ensure stability. This model connects traditional finance and Web3. Additionally, Eric Trump’s visit to Hong Kong is a diplomatic victory for Hong Kong, reflecting the U.S. recognition of Hong Kong’s Web3 status and the pragmatic shift in China-U.S. relations.

- Danny Deng, CEO of MINAX Global Brand Trading Group: He believes that Web5, formed by the integration of Web2 and Web3, is the future of the digital economy, and blockchain is the core tool for reconstructing production relations. Stablecoins and RWA may break through existing issuance limitations in the future, but this must be based on compliance, technology, and social consensus, and development in any region must comply with local rules.

- Song Yuhai, Chairman of the Board of Directors of Junwei Capital: He clearly stated that RWA refers to the on-chaining of real assets, with huge scale potential. Brand exchanges aim to promote the on-chaining of brand assets and support RWA development. He also recalled the early application scenarios of Bitcoin in China, witnessing the industry’s transition from “a fantasy” to compliance.

- Han Feng, Co-Founder of Elastos: He advocates that real currencies should be issued with global participation. He is currently developing an AI algorithm to achieve the decentralized pegging of Bitcoin, which is expected to be pegged to the RMB in the future to support its internationalization. He believes that the scale of Bitcoin may surpass traditional assets in the future, and decentralization can address payment blockades in the China-U.S. trade war.

- Zhang Yang, Scottish Whiskey Investment Manager and Director of Loch Lomond Group: As an operator in the real economy, he believes that RWA can solve pain points in the whiskey industry such as cross-border transactions and fractionalization, serving as a medium connecting the real economy and blockchain. He also emphasized that Web3 is a tool rather than a revolution.

- Wang Ping, Former Rotating Chairman of the All-China Mergers and Acquisitions Association and Founder of the China-U.S. Greater Health Industry Investment and M&A Alliance: He pointed out that there is no “complete decentralization” in the real economy, and all behaviors must have boundaries. The essence of Web3 is not a “revolution to subvert the existing system”, but a “tool to improve cross-scope transaction efficiency and gather global consensus”. It must function within a compliant framework and cannot discuss technical idealization in isolation from the real system.

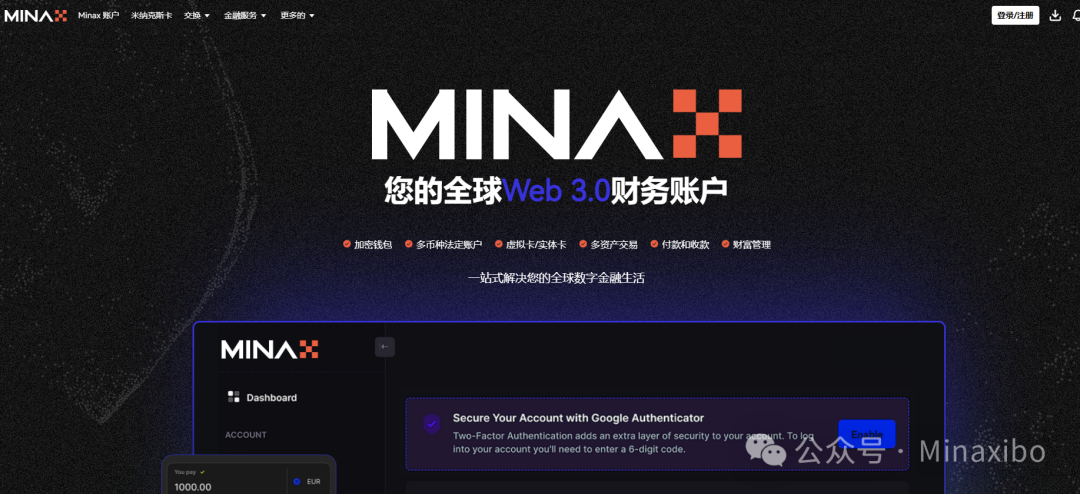

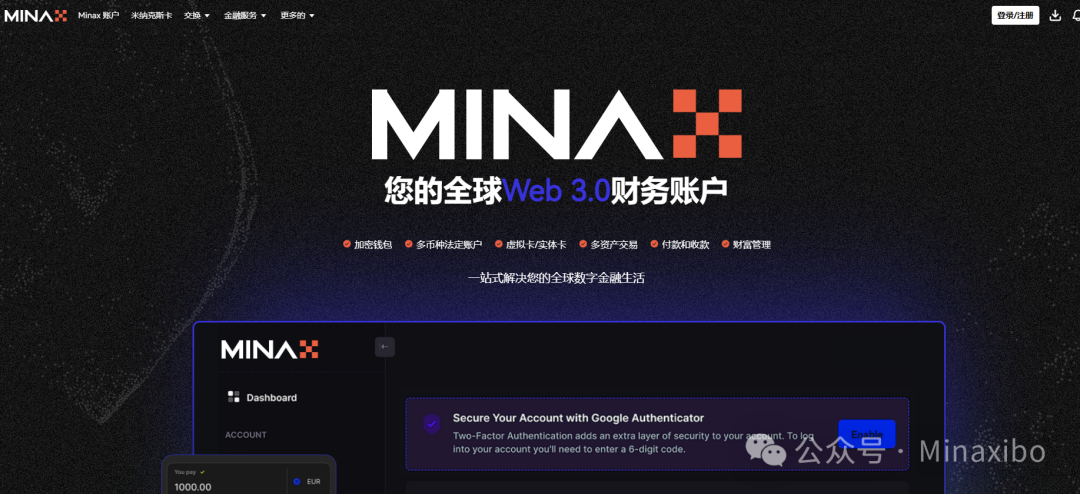

Teresa, Head of MINAX Global Site Operations, gave a detailed on-site introduction to the newly launched global platform. She stated that MINAX has two major trading platforms under its umbrella: minax.io is positioned as the “General Version”, similar to the ChiNext Board (Innovation Board) in the stock market, mainly undertaking the functions of brand RWA incubation, brand community building, and rights redemption to help brands attract Web3 traffic; while the newly launched minax.top is the “Professional Version”, equivalent to the Main Board, with more comprehensive functions and better alignment with the needs of global users.

Head of MINAX.TOP Site Operations – Teresa

minax.top covers a wide range of functions including digital wallets, multi-currency fiat accounts, virtual/physical cards, multi-asset trading, fund transfers (receipt and payment), and wealth management services. Users only need to complete KYC (Know Your Customer) verification once to use their identity across multiple platforms. The platform supports cryptocurrency deposits; through MINAX physical or virtual cards, users can directly purchase cryptocurrencies with fiat currency or convert cryptocurrencies into fiat currency, enabling free fund deposits and withdrawals. This card covers all scenarios involving cash, cryptocurrencies, and cryptocurrency applications, and can fully replace traditional banking functions. For example, when consuming at a coffee shop in Hong Kong, users can directly swipe the card to complete payment; after depositing fiat currency, the system can automatically convert it into mainstream cryptocurrencies such as USDT, Bitcoin, and Ethereum, making it convenient for users to manage assets on the platform. Meanwhile, MINAX Group and its subsidiaries have obtained approvals and licenses in the United Arab Emirates, the European Union, Canada, and other regions, complying with global high-standard regulatory guidelines and providing strong protection for users’ asset security.

After the launch event, four important signing ceremonies were completed in succession to further improve the ecosystem layout:

-

MINAX reached a strategic cooperation with the Shanghai Hunan Chamber of Commerce (Yangtze River Delta) Industry Alliance to jointly promote the RWA transformation of brands in the Yangtze River Delta region;

-

To support the implementation of the ABG Dark Horse Program in Shanghai, MINAX collaborated with Shanghai Yuzenglong Holdings Co., Ltd. and other partners to identify high-quality brand projects;

-

MINAX signed an exhibition cooperation agreement with Yangkui Meteorite Museum to explore RWA innovation for cultural assets;

-

Zhou Wuyin was officially appointed as MINAX Brand Consultant, injecting new momentum into the brand’s strategic planning.

In the subsequent brand bell-ringing session, Danny Deng, CEO of MINAX Global Brand Trading Group, attended as a core guest and jointly “rang the bell” for two brands with many industry figures:

As a representative of high-quality physical brands, GLOBAL X-CHANGE launched a new journey of asset digitalization together with MINAX. Relying on a professional limited partnership fund cask-storage model, GLOBAL X-CHANGE has deeply engaged in the whiskey collection and investment field. This time, by leveraging MINAX’s brand RWA trading ecosystem, it combines physical whiskey assets with blockchain technology, breaking the geographical and liquidity limitations of traditional alcohol investment and allowing ordinary investors to participate in sharing the value of high-quality whiskey assets through compliant channels. At the event site, Zeng Hongfang, Cask-storage Consultant of GLOBAL X-CHANGE Limited Partnership Fund, gave a detailed introduction to the brand’s advantages and RWA transformation plan. Later, she jointly rang the bell with guests including Danny Deng (CEO of MINAX Global Brand Trading Group), Dr. Xia Chu (Strategic Consultant of Shanghai Shutu Blockchain Research Institute), and Zhang Yang (Global Managing Director and Partner of Loch Lomond Group), marking a new step in the integration of physical alcohol assets and RWA;

Hosted by Dai Shanshan, CEO of BitKoala, Danny Deng jointly rang the bell with guests including Hu Hao (Honorary Consultant of Tencent) and Jia Baojun (Member of Tsinghua University Alumni Association), deepening MINAX’s cooperation with blockchain technology brands.

During the brand roadshow session of Crypto Raver HK and the MINAX Brand Listing Forum, Yuanda Liushi (a high-quality project in the TCM health field) and MZH (a fashion project targeting Muslim women) made their appearances, providing new models for the RWA transformation of physical assets in different fields:

Teng Wei, Founder and Chairman of Xide Capital (also serving as Financial Consultant and Empowering Investor of Yuanda TCM, and Co-Founder of RHETT Fintech), introduced that Yuanda Liushi is a century-old TCM family founded in 1851, now in its 6th generation of inheritance. It holds 33 ancestral secret recipes and multiple national patents; its core product “Qingfei Sanjie Granules” directly addresses the pain point of post-COVID lung nodule progression, accurately entering the 100-billion-level rigid demand market. Offline, it has built a large-scale network of “over 380 stores in more than 80 cities”, forming a diversified business system integrating “TCM diagnosis and treatment + physical therapy services + product sales”. In 2024, its revenue reached 250 million yuan, and it is expected to exceed 580 million yuan in 2025. It has also accumulated more than 500,000 active members, laying a solid foundation in the physical economy.

Founder and Chairman of Xide Capital, Co-Founder of RHETT Fintech

Financial Consultant and Empowering Investor of Yuanda TCM – Teng Wei

Wu Jun, Brand Director/Business Partner of MZH, stated that MZH wins users with products “aligned with beliefs and daily life”: low-saturation “Night Veil” lipstick for morning prayers, alcohol-free perfume suitable for religious services, and high-saturation “Persian Gem” shades for dinners. All products comply with HALAL standards. MZH also announced that it will promote RWA transformation through MINAX, which will not only provide Muslim groups with suitable fashion choices but also open a channel for investors to connect with the 100-billion-level market, achieving a win-win situation for both user value and capital value.

MZH Brand Director/Business Partner – Wu Jun

Crypto Raver HK and the MINAX Brand Listing Forum concluded successfully, marking an important milestone in the digitalization process of the physical industry. From Dr. Gong Fangxiong’s in-depth interpretation of stablecoins and RWA compliant development, to the full-scenario service capabilities demonstrated by the MINAX Global Site, and the successful practices of brands such as Yuanda Liushi and MZH, all evidence that the RWA track has entered a new stage of “segmented deep cultivation and value realization”.

This forum not only efficiently connected high-quality projects with global capital but also set an industry example of “demand-oriented and compliance-first”. Currently, more than ten brands are in the queue for listing preparation on the MINAX platform, covering fields such as consumption, health, culture, and technology, demonstrating strong demand for brand asset digitalization and the platform’s capacity to support it. In the future, MINAX will continue to promote more physical enterprises to achieve asset transformation and value enhancement through RWA, helping global asset digitalization enter a more mature and broader new era.